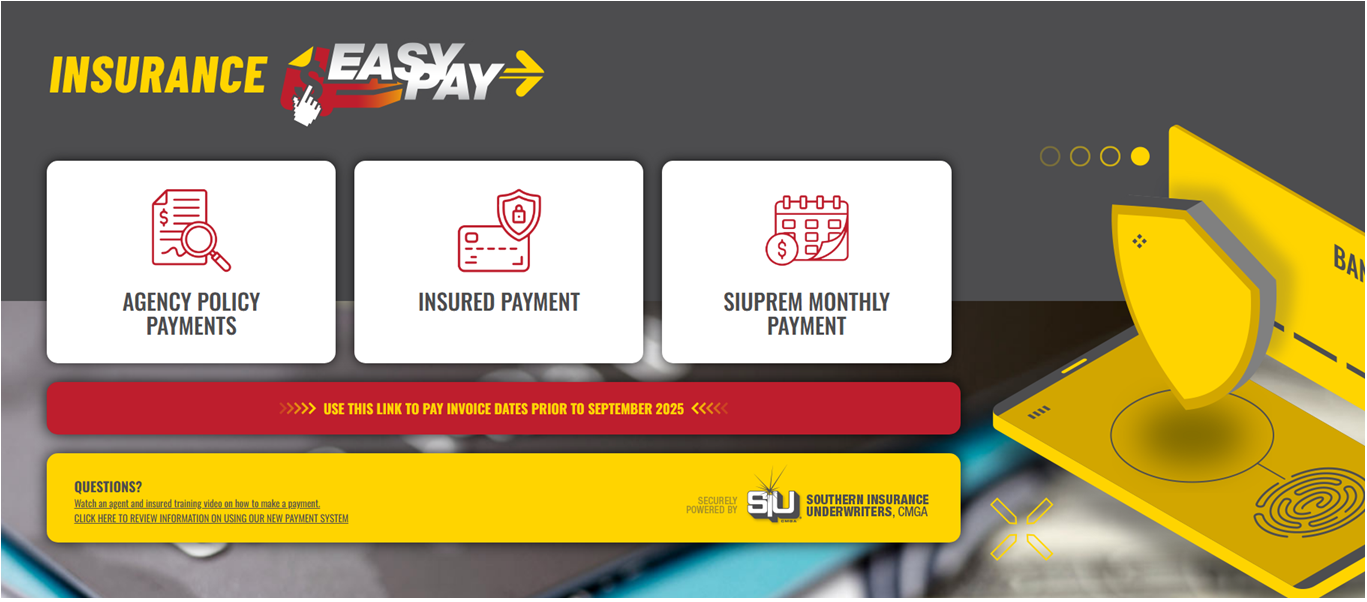

New Accounting & Payment Platform

How to Access EPay from Website

Visit https://site.siuins.com/

Click 'Services' on the top right banner

Click 'Pay Online" on the left-hand drop-down

Click the 'Pay Online" button to access the link to EPay

For Policies Invoices Prior to 9/1/2025

Please use the red button located below the four new payment options in ePay.

Siuprem / Insured Payment Plans

If the insured chooses a payment plan offered by SIUPREM, they’ll make the first down payment using the Insured Payment button. After that, all monthly payments will be made through the SIUPREM Payment Portal.

Insured Payment

Quotes can be paid using the insured payment button. Enter the Account/Quote Number and billing Zip to bring up the payment amount. This is also true for the first payment (full payment or down payment) on bound and invoiced direct bill policy. System will pull in a full payment amount but you can adjust by manually entering the down payment amount.

Which Zip Code to Use

To log in to EPay for both agency and insured payments, users must enter the billing zip code.

Login and Payment Step-by-Step Instructions

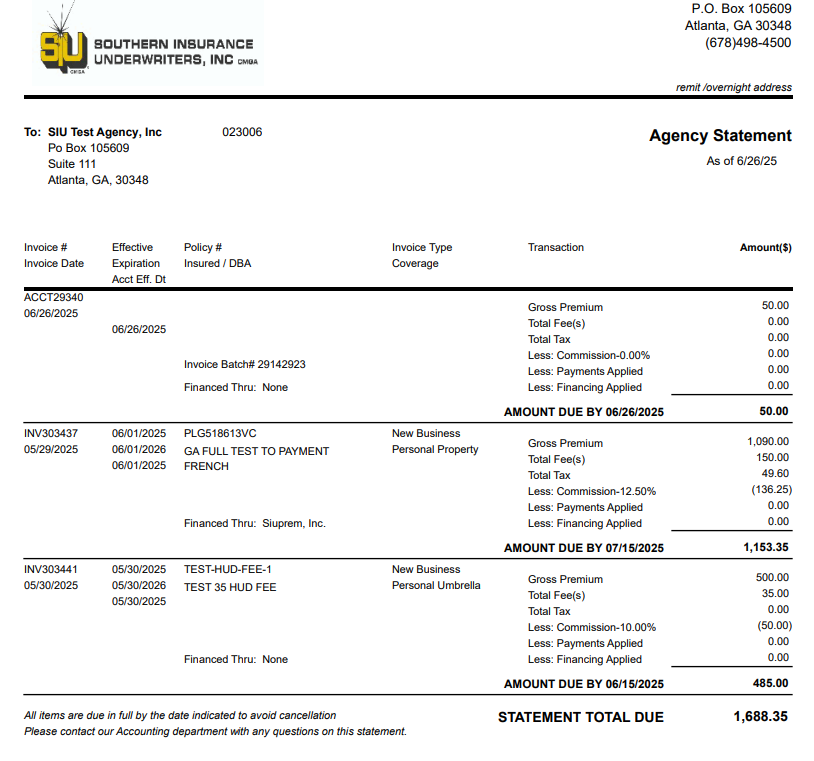

Understanding Your Statement

DELIVERY

ACCESS

ACCOUNTING CONTACTS

ACCOUNT

Check the Agency Information

-

At the top-left under “To:”, you’ll see the name and address of the agency receiving this statement (e.g., SIU Test Agency, Inc.).

-

The agency number (023006) is also

Note the Statement Date

- Found in the top right under “Agency Statement”, this shows the effective date of the statement — As of 6/26/25.

Understand Each Invoice Line Item

Each invoice is listed in a row with its details. You’ll typically see:

-

Invoice #: Reference number for that billing item (e.g., INV303437).

-

Invoice Date: When the invoice was created.

-

Effective / Expiration Dates: These refer to the policy's start and end dates.

-

Insured/DBA: The name of the insured or policyholder (e.g., GA FULL TEST TO PAYMENT FRENCH).

-

Policy #: Identifier for the insurance policy (e.g., PLG518613VC).

-

Invoice Type: Indicates if it’s New Business, Renewal, Endorsement, etc.

-

Coverage: Type of insurance (e.g., Personal Property, Personal Umbrella).

Review Transaction Breakdown

For each invoice, you’ll see monetary details:

-

Gross Premium: Full premium before fees or commissions.

-

Fee(s): Any policy or administrative fees.

-

Tax: State/local premium taxes.

-

Less: Commission: The agency’s earned commission (e.g., -$136.25).

-

Payments Applied: Amount already paid.

-

Financing Applied: Any amount financed through a third party.

-

Amount Due: The final amount the agency owes after all adjustments.

Look at Due Dates

Directly below each transaction, you’ll see AMOUNT DUE BY [date] — this is critical to avoid cancellation.

-

Example: One item is due by 07/15/2025, another by 06/15/2025.

Important Note

- If the policy was financed through a third party (e.g., Siuprem, Inc.), this is shown under “Financed Thru”. If none, it says “None.”

- At the bottom, the STATEMENT TOTAL DUE shows the full balance owed across all line items (here: $1,688.35).

- The statement includes a note: “All items are due in full by the date indicated to avoid cancellation.” Reach out to accounting if anything is unclear.

Additional Information

PAYMENT DUE DATE AND LATE FEES

- Payment must be received by the 15th of the following month.

- Accounts not paid on time are considered past due.

- A 1.5% monthly service charge applies to all past due accounts.

- Agents with past due balances:

- Are restricted from writing business

- Risk policy cancellation for non-payment of premium

- Are restricted from writing business

RETURNED PAYMENTS

- If a payment is returned unpaid:

- The agency will be restricted from writing business

- Payment must be replaced with:

- A certified check

- A money order, or

- A transaction through the EPay online portal

- A certified check

- The agency will be restricted from writing business

- A $20.00 fee will be charged for each returned check

REINSTATEMENT PROCESS

- After payment is processed:

- Underwriting and payment history will be reviewed

- The agency will receive written notification if reinstated

- Upon reinstatement, the agency may resume writing business

- Underwriting and payment history will be reviewed

EPAY ONLINE

- Debit/Credit (Visa, MasterCard, Discover)

- Credit and debit card payments have a 3.5 percent transaction fee.

- ACH payments have a flat $3 fee.

CHECK BY MAIL

- Agency

- Insured

- Mortgage Company

- Finance Company

Mailing Address: PO BOX 105609 Atlanta, GA 30348-5609

CERTIFIED FUNDS

- Money Order

- Bank Check

STATEMENT RENDERING AND DUE DATE

- Statements are rendered once at the end of each month and payment is due by the 15th of the following month (i.e., August statement is due by September 15th).

REPORTING DEDUCTIONS

- Any deductions from the statement total must be reported on the Agency Account Current Statement in the “Reason for Deduction” section.

INVALID DEDUCTIONS

- Premiums not collected by your agency. All items billed on your account are at your request and must be paid.

- Credits for cancellations and return premiums not yet processed. SIU computes return premiums on the effective date of cancellation at which time a credit memo is sent to your office, and such credit will then be shown on the statement.

- Credit for outside financing cannot be deducted. If the finance company does not pay by the invoice date, your account is still payable and therefore past due.

- Credit for SIUPREM financing can only be deducted if the executed finance agreement is submitted in a timely manner.

- Endorsements which have not been processed.

- Items which you have previously been advised were invalid deductions in prior months.

SIU does not mail paper statements.

STATEMENTS

- Statements are available the 1st business day of the month online at siuins.com.

- We Email both Agency Bill and Direct Bill Statements separately.

- A PDF version of the statement will be emailed to both the primary and secondary accounting contacts.

- The email will also serve as notification for the agency that the new statement is available online.

- The due date for payment is the 15th of the month

WHAT NEEDS TO BE DONE?

- Update/confirm the Agency Accounting contact(s)

- Use the chat feature online

- Send an email to marketing@siuins.com

- If any contact at the agency needs to view statements online and does not have access contact marketing@siuins.com.

WHAT IS THE LOGIN INFORMATION?

- Usernames are based on the email address on file

- Forgot the password? Click the 'Reset Password' button on the login area to have password reset and sent to your email

Our preference is to direct deposit all commissions and credit balances for our agency partners.

WHAT NEEDS TO BE DONE?

- Download the Direct Deposit Authorization form (click here to download)

- Complete the form and be sure to attach a copy of a VOIDED CHECK

- If you are having issues with the online , form email the Authorization form and voided check to our secure email address: accountingsecure@siuins.com

Frequently Asked Questions

Do I need to sign in to make agency payments on the new site?

No, the sign-in button on the top right of the screen is for Epay accounts. It is not necessary to create an account or sign in to pull invoices or make payments. Enter your SIU code and billing zip in the main body of the screen.

Making a down payment when quoting online using the SIU Personal Lines HO3 and DP Rater.

When transitioning to the payment platform, there will be a delay of approximately one minute. Only the full payment will upload to the payment processing platform. You'll need to adjust by manually entering the down payment amount and then proceeding with the payment.

When is the payment for my Agency Account Current Statement due?

Payment is due on the 15th of the following month.

How may I obtain a copy of my producer statement?

Choose the Download Your Statements option on the Agency Admin drop-downside menu.

Login to EPay using your SIU credentials and then you can search, sort and pay any open balance online.

What do I do if I believe there is an error on my statement?

Please feel free to call any member of our Accounts Receivable staff with any billing questions.

Will you accept an Insured Check?

Yes, for Agency and Insured bill policies only. Carrier direct bill payments should be sent directly to the Carrier(s). Insureds can also pay online at www.insuranceeasypay.com

Why is the commission for a personal property mortgagee bill policy not on my direct bill accounting statement?

Mortgagee bill policies now are booked as an agency bill invoice type because they are not true company or insured direct bill. For mortgagee bill renewals, we typically do not bind until we receive payment, unless we receive a special request. We still send the renewal offer and invoice directly to the mortgage company the difference is the invoice transaction type.

A credit balance on the agency bill accounting statement is distributed monthly based on the balance after the 15th of the month.

My agency has a credit balance on our monthly producer statement. When will I receive a refund?

Credit balances on agency bill statements are automatically distributed between the 10th and 20th of each month.

Agencies may now sign up for direct deposit for credit balance and refunds. Please download the ACH form here to begin the enrollment process!

How will I receive my commission on Direct Billed policies?

SIU offers direct bill programs on certain carriers and certain lines of business. Your Agency Direct Bill Commission Statement is generated at the end of each month and is available for download online at www.siuins.com. If you owe money on your agency bill statement, you can use commissions to pay money due to SIU. We will not distribute commissions if the overall balance owed to SIU is negative and not under review.

There is one direct bill carrier that sends checks directly to the agent: GeoVera Specialty.

I received my GeoVera Specialty Direct Bill commission check. How do I tell what policies it is paying commission for?

Commission statements are not mailed with GeoVera Specialty direct bill commission checks. You may download a copy of your GeoVera Specialty direct bill commission statement from the GeoVera Specialty Website. Please contact our Personal Property department for details.